KRMS will immediately save your cost by replacing non Critical roles with our offshore team. You can access to the new global workforce of the future, especially talent from professional and dedicated work force with comparable Skills, cost advantage, automated information reporting system.

Bookkeeping is the backbone of every business. Having up-to-date and organized records helps you monitor business performance, keep track of expenses and revenue, and comply with the necessary requirements set forth by governing bodies to verify the validity of your operations.

But taking on the task of tracking every transaction on top of your core responsibilities may be too challenging on your own. Bookkeeping requires a dedicated staff or team, even for small to medium businesses. After all, compiling data and crunching numbers should only be second to your primary focus: growing your business and engaging your clients.

Understandably, creating a 100% onsite bookkeeping team can be too costly for your business. When talent is scarce in your area, local bookkeepers may charge exorbitant fees, not to mention it can be harder to retain them in the long run.

A cost-efficient growth strategy for your small business would be to outsource bookkeeping to the KRMS. One of the top benefits of outsourcing accountants and bookkeepers is getting access to a talent pool of experienced accounting professionals eager to join the business process outsourcing (BPO) industry and build their careers internationally.

We’ll provide full-time bookkeepers who work exclusively for you. You will have full control over the processes, technology, and work shift of your offshore bookkeeping and accounting team. To help you get started on your bookkeeping team outsourcing, we’ve listed some of the crucial tasks you can delegate to your team:

• Accounts payable (entering bills, Payments)

• Accounts receivables (Invoicing / Entering collection )

• Daily general ledger maintenance

• Time tracking & job cost reporting

• Payroll processing

• Expense classification

• Sales commissions

• Sales and use tax filing

• Bank account reconciliation

• Credit card reconciliation

• Balance sheet generation and review

• Budgeting & forecasting

• Balance sheet creation

• Profit and loss statement (monthly)

• Profit and loss statement (YTD)

• Profit and loss statement by class (monthly)

• Profit and loss statement by class (YTD)

• Cash flow statement preparation

• Accounts receivable aging

• Accounts payable aging management

• Prepaid expenses by vendor

• Accrued expenses by vendor

• Deferred revenue by customer

• Open sales order by customer

• General ledger management

• Financial statements & custom reporting

• Inventory management

• Foreign banking management

• Fixed asset management

• Coordinating with your CPA or tax adviser

• Tax & audit support

Getting paid on time is a must for every employee, and avoiding costly mistakes such as overpayment or late salary issuance should be a standard for every company. It’s easy for smaller organizations with five to 10 employees to comply with payment records and timelines. But if you’re a growing business, an offshore payroll team can provide the support you need to maintain efficiency.

Since outsourcing to local payment management companies may not be a viable option due to the expensive fees, many small to medium business owners leverage payroll outsourcing to the Sri Lanka and other low-cost labour countries to handle their end-to-end pay-out services to maximise cost savings, efficiency, and access to the latest technologies.

You can outsource your payroll processing to the Sri Lanka and other countries, including the ones below, with our comprehensive staffing solutions that include highly qualified payroll specialists.

• Wage calculation

• Tax calculation and deduction

• Payment of employee contributions to government agencies

• Generation of payslips and other pay-related reports

• Management and resolution of pay discrepancies

• Implementation of payroll policies

• Tracking, monitoring, and reconciliation of payment records

• Setting up key performance indication for each job roll based on job Discription.

• Measurement of actual performance of each job roll against the KPI and give marks.

Managerial accounting is the practice of identifying, measuring, analyzing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals.

Managerial accounting differs from financial accounting because the intended purpose of managerial accounting is to assist users internal to the company in making well-informed business decisions.

• Reduce costs.

• Ensure flexibility and responsiveness in the processes.

• Have a dedicated team.

• Look for service quality and efficiency.

• Increase productivity and focus on the core business.

• Security and accountability.

• Access to global resources.

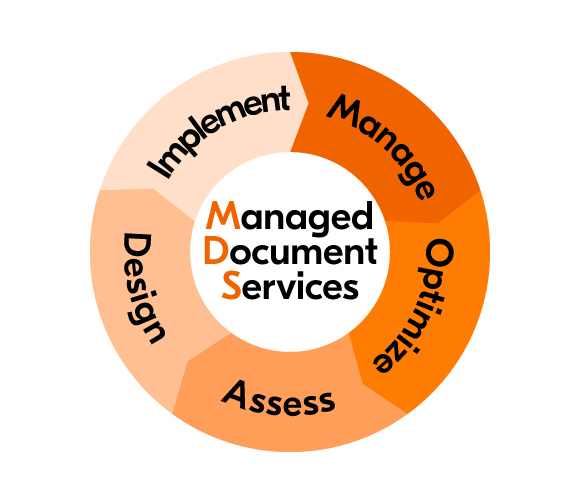

KRMS are providing meaningful information and data for short-term and long-term planning and forecasts for business operations, Using passed data and future planning of your company.

KRMS will organize your human and non-human activities. Using data, KRMS budgets and ascertain individual cost centers and then delegate the budget to each different centre. It will improve the finance and accounting function of the business on modern lines

KRMS will check work done with common goals to analyze whether it is accomplished. KRMS will control the organization’s performance by utilizing budgetary control, standard costing, fund and cash flow statements, accounting ratios, cost reduction programs, return on investment, and analyses of capital expenditure programs.

KRMS offers various coordinating tools such as financial analysis, budgeting, financial reporting, analyses, interpretation, etc. These tools enhance the efficiency of the organization and increase its profits. KRMS assists the management by analyzing the cost and financial accounts by preparing budgets, evaluating standard costs, and analyzing variances in cost.

KRMS analyzes the information and presents it to management and top authorities. KRMS also add suggestions and comments in a non-technical way so they can easily interpret and find results. Analyzing the data is to plan appropriately and make effective decisions for the same data presented in the form of ratios, comparative statements, and projected trends

KRMS provide accounting data and statistical information. It aids in the effective decision-making required for the successful survival of the business. Using data, KRMS determine the long-term and the short-term capital and suggest capitalization required for the business. Also, it evaluates additional capital expenditure proposals and their effect on the return on profit and losses.

Microsoft Power BI advantages could be the right choice for any business big, medium, or small that is looking for reporting and analytical capabilities beyond Excel as it offers easy data visualization and analysis across the entire business and gets deep insights into the business operation and performance.

Here is a rundown of the undeniable Power BI benefits that all types of businesses can available as per their business needs.

• Select and Clean data set you want to represent visually.

• Select the data sources.

• Create a data model.

• Establish relationships between tables.

• Visualize the data.

• Design the dashboard.

Complying with tax laws is highly important, as even small errors can have serious consequences. Lack of expertise and knowledge and accordingly, a high number of mistakes made while calculating taxes, creating tax reports, and submitting tax returns lead to significant financial losses in the form of tax debt and fines. There may be fines, back taxes, interest, and other financial penalties levied if a company fails to fulfill its corporate compliance requirements. By seeking timely tax and financial advice, client can prevent these effects of these issues that occur in real.

• Prepare tax calculation, tax working and other required information with the consultation of your tax expert.

• Filling tax return on time

• Maintain check list for all tax payment with the dead line and we will communicate with all working to pay tax on time

A business plan is describing a business, its products or services, how it earns (or will earn) money, its leadership and staffing, its financing, its operations model, and many other details essential to its success. It usually also includes a marketing plan, mission statement, and brand values.

Often, financial institutions and investors will need to see a business plan before funding any project. But even if you don’t plan to seek outside funding, a well-crafted plan becomes the guidance for your business as it scales.

1. Draft an executive summary

2. Write a company description

3. Perform a market analysis

4. Outline the management and organization

5. List your products and services

6. Perform customer segmentation

7. Define a marketing plan

8. Provide a logistics and operations plan

9. Make a financial plan

KRMS will properly check whether your Company follows the internal protocols, regulations, and standards. Every organization has a specific set of rules to follow.

KRMS is providing following internal Audit Services.

KRMS checks whether the company complies with the rules, regulations, and laws of the region, state, or country it operates. In case of non-compliance, firms are subject to payment of fines and penalties or other punishments.

KRMS will check that the companies’ standards and core competencies are efficiently met. The management sets these standards, expecting employees and the overall workforce to strengthen their performance while remaining compliant with the standards and regulations.

KRMS will check how efficiently a business works to achieve its set output. Starting from quality control, accounting controls to human resources function, KRMS assess every aspect of the company. In addition, KRMS will offer advice and guidelines to improve the operational procedures to enhance the company’s efficiency and effectiveness.